By Yan Chang | Pixel Insight | Beijing, Oct. 27, 2025

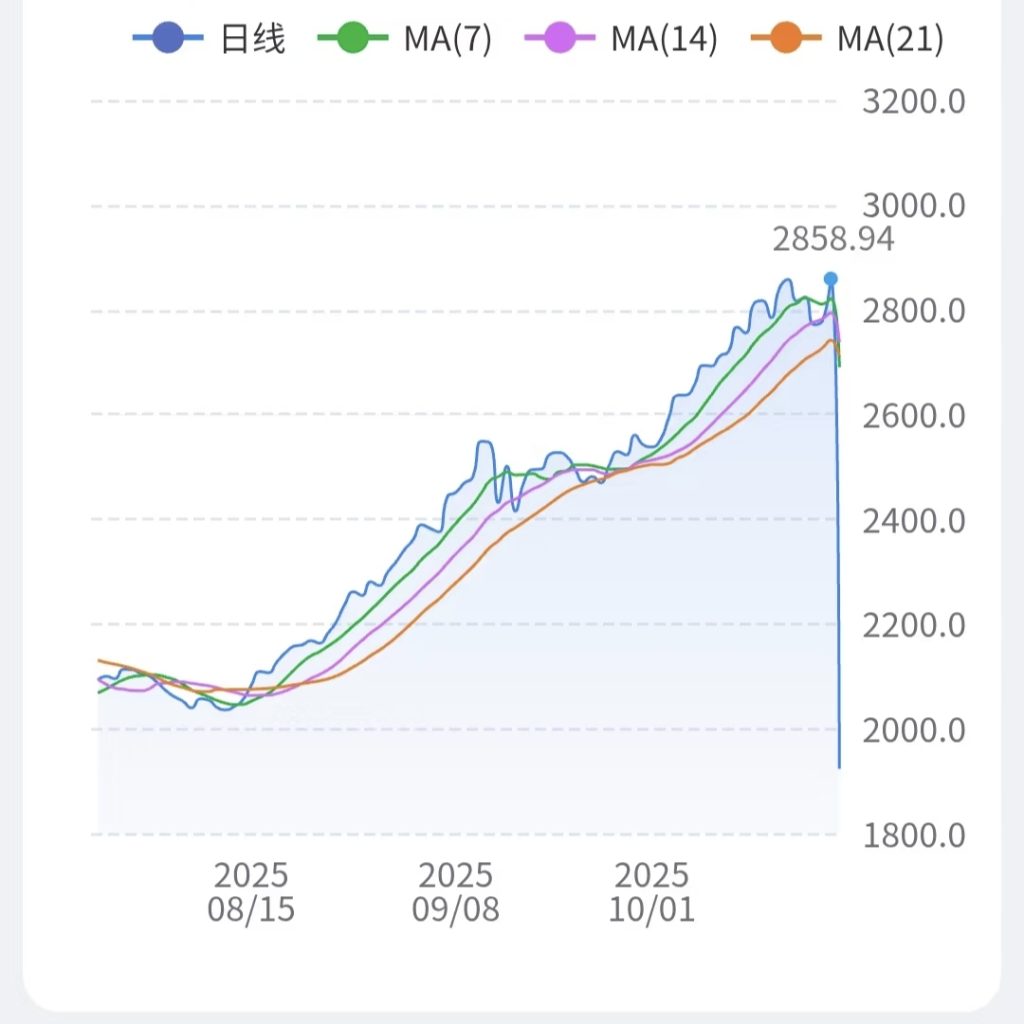

When Valve rolled out a long-awaited crafting update for Counter-Strike 2 earlier this month, few expected it to trigger one of the biggest market corrections in the game’s history. Within days, the prices of rare in-game skins — some once valued at tens of thousands of yuan — plummeted.

For some players, the update was a long-needed correction to an overheated market. For others, it felt like years of collecting and trading had suddenly lost all meaning.

To understand what the crash means for everyday players, Pixel Insight spoke with Alvin Wang, a student at Fudan University’s School of International Relations and Public Affairs, who has been part of the Counter-Strike community for nearly a decade.

From a Casual Player to a Witness of a Market Collapse

“I bought CS:GO back in 2014 or 2015,” Wang recalls. “But for the first few years, I barely played. The game wasn’t popular in China yet, and there wasn’t really a domestic skin market.”

That changed after 2021, when Counter-Strike: Global Offensive saw a massive resurgence in China. Wang’s playtime grew from a modest 150 hours to more than 1,400 hours today. He began buying and selling a few skins — never as an investor, but as a gamer who appreciated the aesthetics.

“I never held more than 5,000 yuan worth of skins,” he says. “It was just for fun. I didn’t think about price fluctuations or returns.”

But that self-imposed detachment didn’t make this month’s crash any less fascinating to watch.

How the Update Broke the Market

The Counter-Strike skin economy has long operated under a simple rule: rarity drives value. Skins are divided by color tiers — from blue to red to gold — with gold-tier items like knives and gloves being the rarest and most expensive.

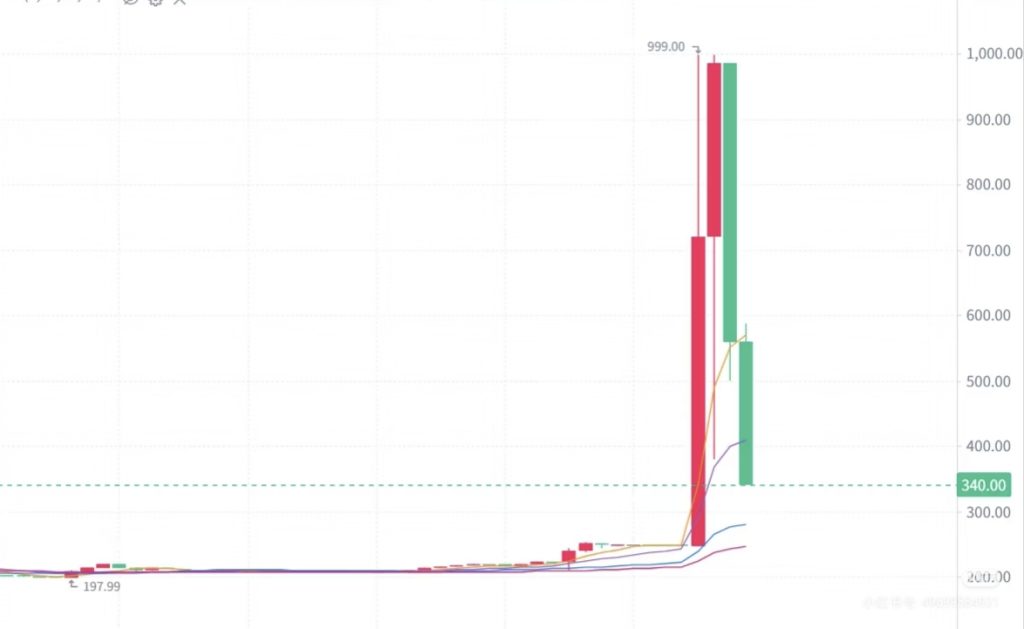

Players could only obtain gold skins through low-probability loot box openings, making them both status symbols and investment assets. Some knives sold for more than ¥100,000, and the market had been remarkably stable thanks to Valve’s consistent rules and a growing player base.

“The update changed everything,” Wang explains. “Now, you can craft a gold skin using five red skins. That completely changes the supply structure.”

In other words, what was once nearly uncraftable is now within reach — at least mathematically. The result: the perceived scarcity collapsed overnight, and with it, prices across the board.

When Digital Wealth Vanishes Overnight

Wang wasn’t among the hardest hit, as he had sold most of his holdings before CS2 launched. But many of his friends weren’t so lucky.

“I know one friend whose inventory was worth between ¥50,000 and ¥100,000 before the update,” Wang says. “I haven’t heard him complain, so I assume he’s handling it well.”

Still, the silence might mask anxiety. For some traders, skins weren’t just digital collectibles — they were financial instruments. “A lot of people thought prices could only go up,” Wang notes. “The player base was growing, Valve’s policies were stable, and skins were freely tradable. That created a lot of confidence.”

In that environment, “flippers” — known in Chinese gaming slang as “倒狗” — bought up large quantities of skins to manipulate prices and profit from market hype. Their actions inflated prices far beyond what most casual players could afford.

‘I Support the Update — Even if It Hurts’

Despite understanding the pain of those who lost money, Wang says he supports Valve’s decision.

“This update helps rebalance the ecosystem,” he argues. “It was getting ridiculous. A decent-looking knife cost several thousand yuan. Ordinary players couldn’t afford it. Some had to rent skins, which made prices rise even more. It wasn’t healthy.”

By making high-tier items easier to obtain, Valve effectively broke the cycle of speculation. “From a long-term perspective, I think it’s good for the game,” Wang says. “It makes Counter-Strike about skill and fun again, not financial portfolios.”

But the human cost remains. “I’ve seen players cry online,” he says. “Some lost thousands, even tens of thousands. They weren’t flippers; they just liked their skins. It’s sad to see them punished for something out of their control.”

The Future of a Fragile Economy

Wang himself has no plans to reenter the market. “The volatility is too high,” he says. “Before, everything was stable. Now, Valve has shown they can change the rules anytime. You can’t predict what’s next.”

For a market once praised for its “real economy” dynamics — complete with liquidity, speculation, and profit — this update is a stark reminder that even digital markets are subject to the power of their creators.

Whether prices rebound or stabilize at a lower level, one thing is certain: the Counter-Strike skin market will never look quite the same again.

Expert Insight — Why the Skin Market Was Doomed to Crack

While players like Wang view the crash through the lens of community and fairness, some financial professionals see it as an inevitable correction in a system never designed for stability.

On Xiaohongshu, a user identifying himself as a securities trader shared a pointed analysis of the structural flaws in the Counter-Strike skin market — likening it to an illiquid, overregulated version of NFTs. The post, which was publicly accessible on Oct. 25 and viewed by Pixel Insight, can be found here.

“T+7 — that says it all,” he wrote. “You can’t short-sell, there’s no margin trading except for agents, and every asset is non-standardized. It’s basically NFTs without the blockchain transparency.”

He broke down the flaws one by one:

- T+7 settlement: trades take a full week to clear, locking up liquidity.

- No short-selling or margin mechanisms: traders can’t hedge or balance risk.

- Non-standard assets: every skin is unique, with no fungible equivalents.

- No order book or automatic matching: all trades are C2C, person-to-person.

- Thousands of item variants: combined with the above, this destroys liquidity.

- Poor liquidity and structural inflexibility: prices become distorted and easily manipulated.

His conclusion was blunt:

“Speculating on memecoins is safer than trading skins,” he wrote. “At least memecoins have liquidity pools and no cooldown periods — you can run faster than the market makers.”

This trader’s critique underscores a reality long ignored by gamers and investors alike: the Counter-Strike skin economy mimics financial systems, but without any of their safeguards. When virtual scarcity meets opaque control and illiquid assets, volatility isn’t a bug — it’s the rule.

One response to “After the Crash: How a Game Update Shook the Counter-Strike Skin Economy”

impressive